- The Diligent Observer

- Posts

- Saliva Diagnostics, the AI Safety Movement, and Why "Access to Capital" Isn't a Problem

Saliva Diagnostics, the AI Safety Movement, and Why "Access to Capital" Isn't a Problem

🔥 Angel Deals of the Week | August 14, 2025

Happy Thursday.

In today’s issue:

Angel Deals of the Week

Bookmarks I think you’ll enjoy

The best nugget from my conversation with Quinn Robertson, Director of 412 Angels.

Exclusive opportunity for angel network leaders

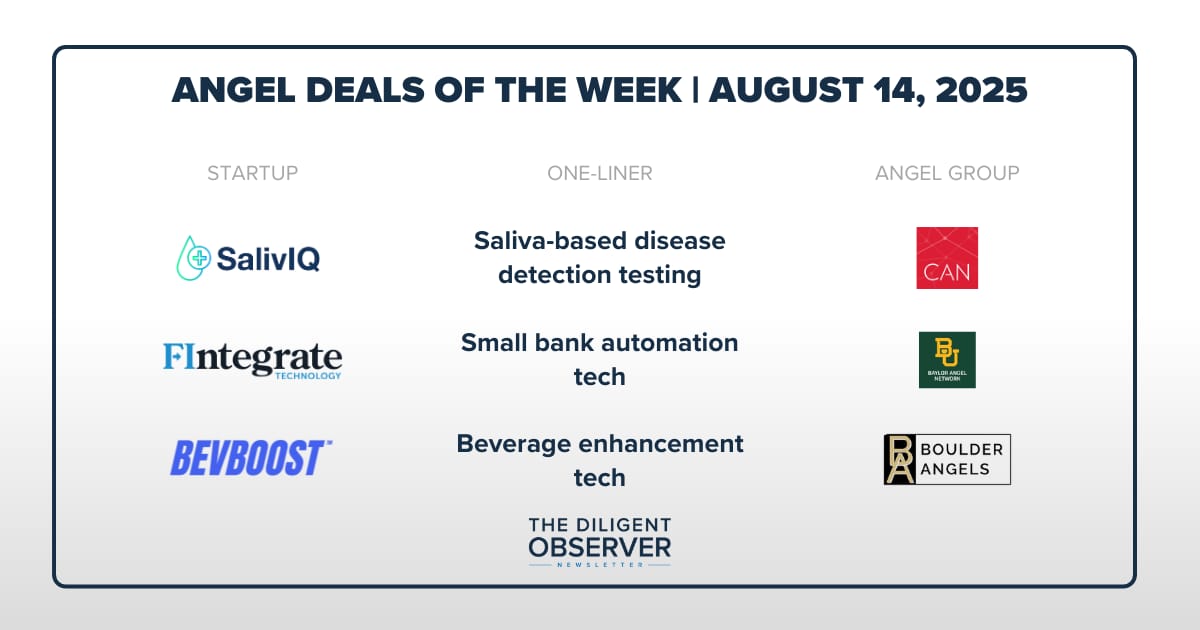

🔥 Angel Deals of the Week

Angel funding rounds announced in recent weeks, compiled from public sources. These deals represent the elite few that survived an angel network’s vetting process. Note: I have not personally analyzed these companies and am sharing for informational purposes only.

🤖 Deal summaries generated using dealmemo.ai.

🧾 Check out every deal we’ve tracked here.

SalivIQ Diagnostics | Saliva-based disease detection testing

Participating Group: Charlottesville Angel Network

SalivIQ Diagnostics is developing saliva-based diagnostic tests for strep throat detection as an alternative to traditional throat swabs. The company's patent-pending method enables patient self-collection at check-in, designed to improve compliance and streamline clinical workflows. SalivIQ recently secured funding from the Charlottesville Angel Network as part of a $2M Seed Round, with funds designated for FDA clearance, team expansion, product launch, and preparation for scale.

Julia Halterman, PhD | $2M Seed | Harrisonburg, VA | August 2025 | Exclusive

FIntegrate Technology | Small bank automation tech

Participating Group: Baylor Angel Network

FIntegrate Technology develops AI-powered agentic process automation for community banks and credit unions, targeting collections and recovery, fraudulent disputes processing, and data migration. The company addresses operational inefficiencies at over 9,400 U.S. financial institutions operating on legacy systems or manual processes within a $2B+ market. Baylor Angel Network recently announced investment in the company to support scaling of sales, marketing, and product innovation efforts.

Kris Bishop | Birmingham, AL | August 2025 | Source

BevBoost | Beverage enhancement tech

Participating Group: Boulder Angels

BevBoost has developed an in-can widget that releases flavor concentrates or nitrogen upon opening to enhance carbonated beverages. The company serves brewers and sparkling beverage brands seeking to extend product freshness and shelf life. BevBoost's widget is currently deployed in Upslope Brewing Company's Hop-Boosted IPA and has partnered with UK-based Morrow Brothers for international expansion. Boulder Angels recently announced completion of their third investment in the company.

Matthew Cutter, Steve Savage | Boulder, CO | August 2025 | Source

📣 Have an Angel Deal to Announce?

🔖 Bookmarks

⚔️ AI Talent War: Another week, another enterprise AI acqui-hire. Anthropic bags Humanloop's founding trio.

🎲 Perplexity Offers to Buy Chrome: Banking on a forced divestiture ruling and raising double their latest $18B valuation, Aravind Srinivas is so much fun to watch.

🏛️ Inside the AI Safety Temple: NYT deep dive into Lighthaven, the Berkeley complex where “the Rationalists” shape Silicon Valley's approach to AI risks and development.

🥇 The Nugget: My Top Takeaway from This Week’s Conversation with Quinn Robertson

Capital access is NOT the problem 🗺️

Many founders in tier 2 or tier 3 markets believe they need to move to Silicon Valley or Austin to access capital, but Quinn argues while that may not be a bad idea, it’s certainly not mandatory. For example, he shared how a Web3 founder in Wichita, Kansas successfully cold-DMed crypto/Web3 investor Anthony Pompliano and landed his entire pre-seed round as a result. The capital was always accessible; it just wasn't local.

From Quinn: "You have access to capital, It just may not be within a five-mile radius of where you're sitting right now. There are bridges to be built to capital sources."

Takeaway: Next time a founder blames their fundraising woes on "we have no access to capital here," poke them.

Diligence Questions:

How many investors/VCs have you contacted outside your local ecosystem?

Are you limiting yourself to local investors? If yes, why?

Want more? Check out my full conversation with Quinn 👇

Listen now on Apple Podcasts, Spotify, YouTube, and more.

📢 Angel Group Leaders: Need More Qualified Member Leads?

Every week, hundreds of angel investors read this newsletter. Many are interested in joining an angel group but don't know where to start. So, I’m helping them out.

What group leaders get: Pre-qualified leads for prospective membership.

The Angel Network Curator is LIVE: hit the button below to learn more, including how to sign up to get amplified exposure as a Featured Partner.

P.S. This curation only applies to subscribers who opt in. Everyone else - your info stays with me.

Until Next Week 👋

Thanks for reading - have a great week.

-Andrew

P.S. If you enjoyed this post, could you do me a quick favor? Hit the "like" button or leave a comment with your thoughts. It may not seem like much, but it really helps me out a ton.

How did I do this week? |