- The Diligent Observer

- Posts

- GIFs are the New Billboards, Female Angels Surge 8x, and Why Overpriced Seed Rounds are a Bad Idea

GIFs are the New Billboards, Female Angels Surge 8x, and Why Overpriced Seed Rounds are a Bad Idea

🔥 Angel Deals of the Week | May 8, 2025

Happy Thursday.

Here are your angel deals of the week, some bookmarks I think you’ll enjoy, and the best nugget from my conversation with Kristina Montague, incoming Chair of the Angel Capital Association and Partner at JumpFund.

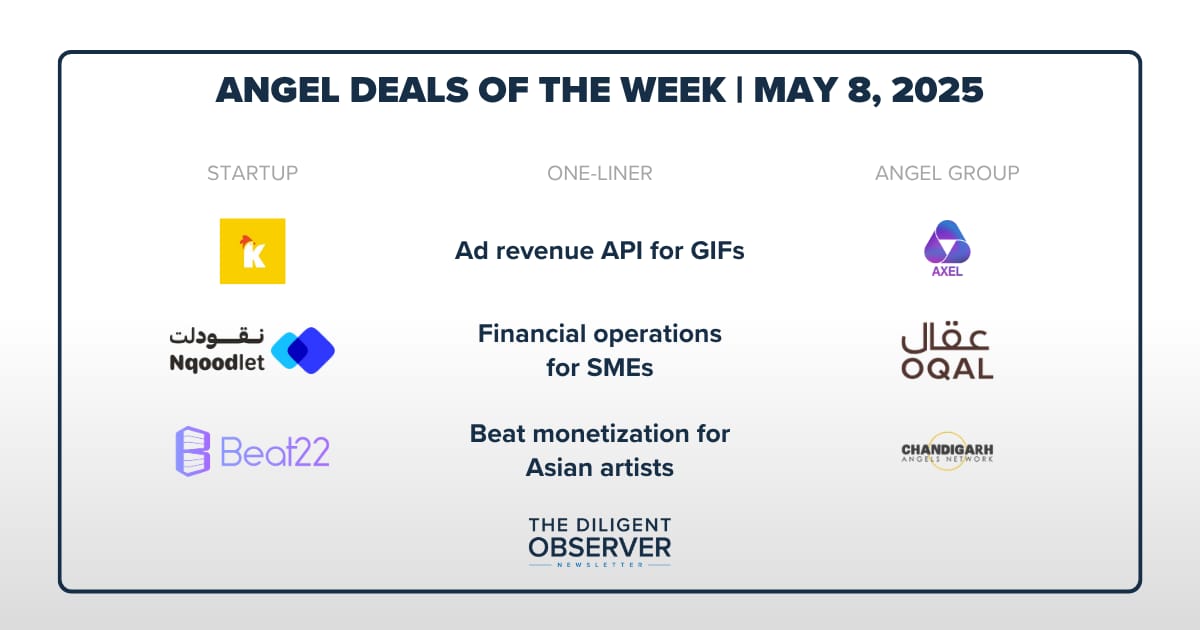

🔥 Angel Deals of the Week

🤝 Recent funding rounds from angel networks. I have not personally vetted these deals and am sharing for informational purposes only. Have one to announce? Reply to this email.

🤖 Deal summaries generated using dealmemo.ai.

🧾 Check out every deal we’ve tracked here.

KLIPY | Ad revenue API for GIFs

Participating Group: Axel Georgian Business Angel Network

KLIPY is developing a monetization API for GIFs and animated content that embeds non-intrusive, contextual ads between content pieces. The company serves 11+ platforms including Slack, Canva, and Figma while handling 4 billion monthly content/ad requests at minimal server costs. The startup recently secured $1.2M seed funding from Sturgeon Capital, Caucasus Ventures, Axel – Georgian Business Angel Network, and angel investors including Zaza Pachulia and Gfycat co-founder Dan McEleney. Funds will support global expansion through onboarding more apps and developing AI tools.

Givi Beridze, Waska Chaduneli | $1.2M Seed | Tbilisi, Georgia | April 2025 | Source

Nqoodlet | Financial operations for SMEs

Participating Group: Oqal Angel Network

Nqoodlet is developing a fintech platform that streamlines financial operations for SMEs across Saudi Arabia and the GCC region. The Riyadh-based company provides smart corporate cards, expense tracking, VAT automation, and integrated financial services to over 600 regional SMEs. Nqoodlet recently secured $3 million in seed funding led by Waad Investments, with participation from OmanTel, 500 Sanabil Investment, Oqal, Seed Holding, and strategic angel investors. Funds will support scaling operations, expanding banking infrastructure, launching new financial tools, and growing their team across the GCC.

Mohamed Milyani, Yara Ghouth | $3M Seed | Riyadh, Saudi Arabia | May 2025 | Source

Beat22 | Beat monetization for Asian artists

Participating Groups: Chandigarh Angels Network (CAN)

Beat22 is developing a creator-first beat licensing platform for independent musicians across Asia, currently serving over 30,000 musicians with more than 50,000 beats in its marketplace. The startup recently secured $2M in seed funding led by SucSEED Indovation Fund, with participation from Chandigarh Angel Network and individual investor Prateek Toshniwal. Funds will be used to expand the user base, develop scalable infrastructure, and create new monetization opportunities for artists in the underserved Asian market.

Ashish Sudhera | $2M Seed | Chandigarh, India | May 2025 | Source

🔖 Bookmarks

📽️ Worth the Watch: Last week The Generalist dropped an 80 minute interview with Roelof Botha, Managing Partner at Sequoia Capital.

🍗 That’s a Lot of Buffalo Wings: DoorDash announced on Tuesday that it was acquiring UK-based Deliveroo for £2.9 billion.

💸 Valuations are Totally Messed up Right Now: Great piece from Clay at Confluence.vc with data from Carta’s Peter Walker on why it’s a bad idea to overprice the seed round.

In partnership with the Angel Capital Association

If you want to connect with experienced angel investors, stay ahead of trends, and tap into a wealth of resources, the Angel Capital Association (ACA) is the place to be. With 15,000+ members and $650M+ invested annually, ACA brings together the best minds in angel investing.

From Angel University’s practical education to the annual ACA Summit and exclusive reports, ACA equips members with the tools and connections to make smarter decisions. I’ve really enjoyed being part of this community, and I highly recommend it to anyone serious about angel investing.

🥇 The Nugget: My Top Takeaway from This Week’s Conversation with Kristina

Female Angels Grew 8x in Just One Decade 📈

Angel investing was once dominated by men, with women representing a tiny fraction of the investor pool. But in just 10 years, female participation in angel investing has exploded from merely 5% to nearly 40% of all angel investors. That’s according to Kristina Montague, incoming chair of the Angel Capital Association and Managing Partner of JumpFund.

From Kristina: "We went from about 5% of all angels were women when we first came into this in 2014 to almost 40% of angel investors are women now. If you look around this room, you would see that almost half of the people here are women."

Takeaway: This isn't just about diversity for its own sake - bringing new perspectives into the room can create opportunity for better returns. Pressure test your strategy by seeking out investor networks with different demographics and investment theses, and consider if a more thoughtful approach to gender-diversity is important to you.

Want more? Check out my full conversation with Kristina 👇

🧰 Toolkit

📚 Read: Get smarter on spotting startup failure modes.

📍 Attend: Cool stuff is happening in Indy - check out RALLY 2025, where 297 VC firms with $27.6B AUM gathered last year. Keynotes by Mr. Wonderful & Molly Bloom, plus a gigantic $5M pitch competition. Get early-bird tickets now, and sign up using code "THEDILIGENTOBSERVER" by 5/31 for an extra $35 off.

⚙️ Level Up: Give your angel group a professional upgrade with PitchFact's managed operations service. They handle deal flow, diligence coordination, member communications, platform management and more - freeing you up to focus on what matters most. Learn more.*

*A message from our sponsor.

Until Next Week 👋

Thanks for reading - have a great week.

-Andrew

P.S. If you enjoyed this post, could you do me a quick favor? Hit the "like" button or leave a comment with your thoughts. It may not seem like much, but it really helps me out a ton.

How did I do this week? |